How Much Are Closing Costs When Buying A Home

The cost of buying a house and moving wondering how much it costs to buy a house or a flat. When you get a mortgage to buy a home youll have to pay closing costs.

How Much Are Closing Costs For Buyers And Sellers

How Much Are Closing Costs For Buyers And Sellers

how much are closing costs when buying a home

how much are closing costs when buying a home is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much are closing costs when buying a home content depends on the source site. We hope you do not use it for commercial purposes.

How much are closing costs.

/home-sellers-paying-closing-cost-credits-4134262_FINAL-b881d78ab2234285b358324624cc0e16.png)

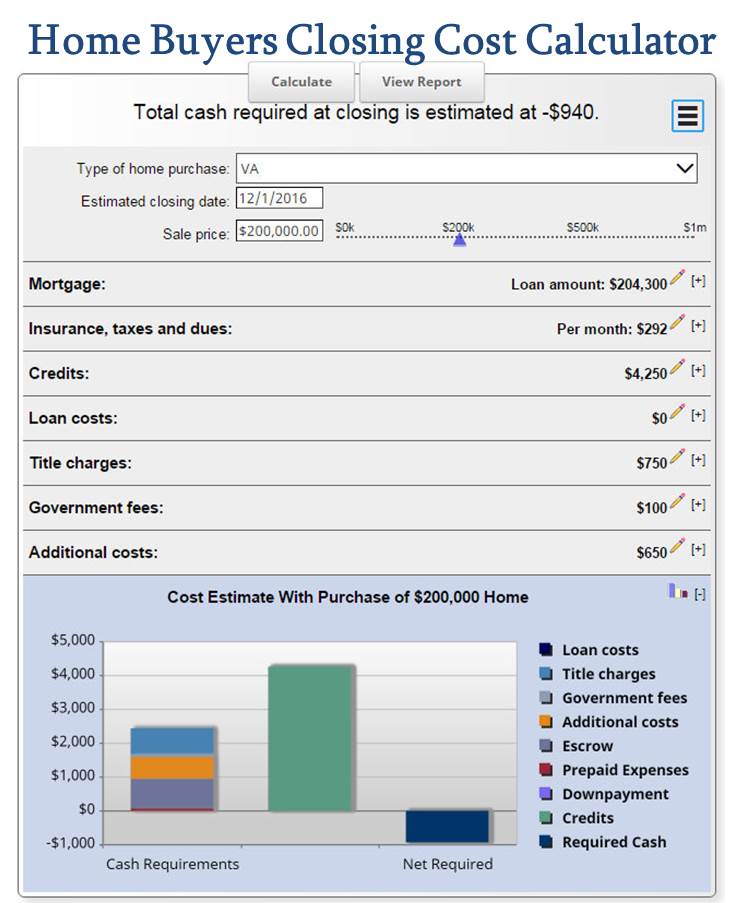

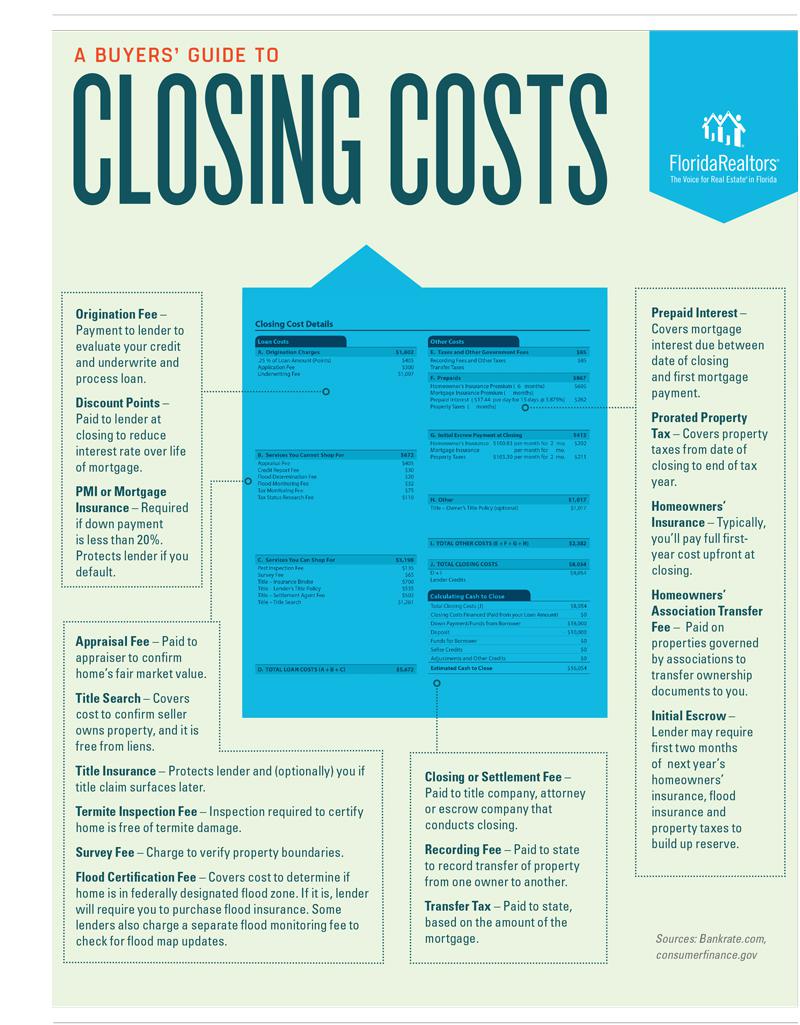

How much are closing costs when buying a home. These fees paid to third parties to help facilitate the sale of a home typically total 2 to 7 of the homes purchase. In this video im going to go over what you need to know about buyer closing cost. On average buyers pay roughly 3700 in closing fees according to a recent survey.

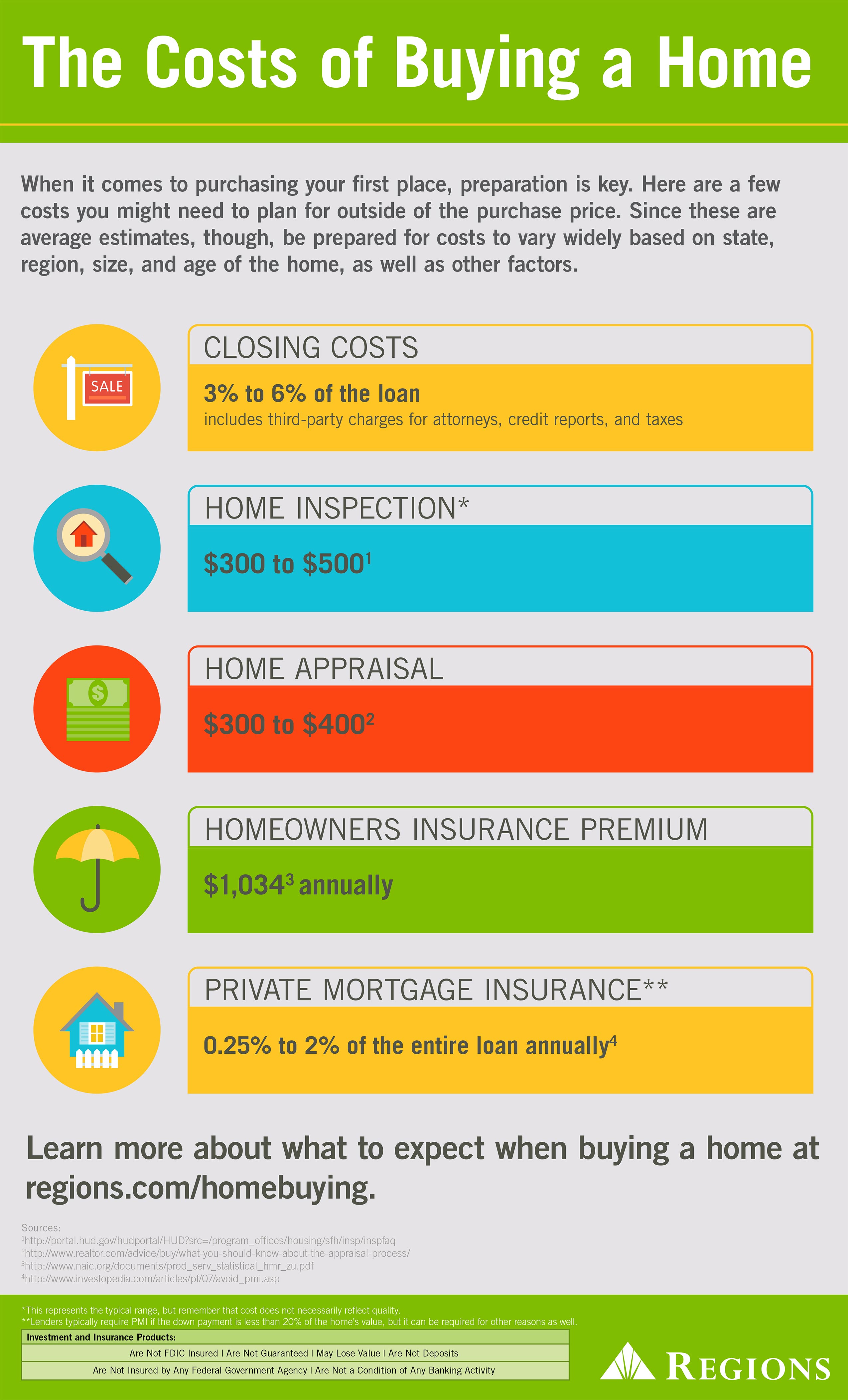

When buying a home in ontario you will most certainly have to deal with ontario land transfer tax. Typical closing costs are around 2 5 of the purchase price of the home. Buying a home involves coming up with a good bit more money out of pocket than just the down payment.

But where you are buying can have a big impact on how much you will pay in closing costs. So on a 100000 home the closing costs will be between 2000 5000. Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees.

There are a number of fees to consider when buying a new house including the cost of moving home your deposit and solicitor fees. To calculate closing costs we assumed a 30 year fixed rate mortgage on each countys median home value and a 20 down payment. Where your real estate purchase is in the city of toronto you will have to pay in addition to the ontario land transfer tax toronto land transfer tax.

So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. Are you are wondering how much closing cost are for a home. Buyers must also have money available for closing costs such as title policies recording fees inspections courier charges reserves to set up escrow or impound accounts and various fees that lenders typically charge.

Add this amount to a typical down payment of 20 or 20000 and it is easy to see why a home buyer would want to limit closing costs as much as possible. For buyers closing cost calculator. Knowing how much closing costs amount to is a big factor in calculating total home purchase costs and in factoring in just how much house buyers can afford.

Like rolling closing costs into your loan opting for a no closing cost mortgage can actually increase your total home ownership costs because no closing cost mortgages almost always have higher interest rates typically 0125 higher than a comparable loan with closing costs. Our study shows closing costs as a percentage of median home value by county.

Typical Closing Costs When Buying A Home Waypointe Realty

Typical Closing Costs When Buying A Home Waypointe Realty

Closing Costs For Home Buyers And Sellers Robyn Porter Realtor

Closing Costs For Home Buyers And Sellers Robyn Porter Realtor

Closing Costs The Basics Of Closing Cost When Buying A House

Closing Costs The Basics Of Closing Cost When Buying A House

Closing Costs Am I Paying Too Much

Closing Costs Am I Paying Too Much

The Costs Of Buying A Home Regions

The Costs Of Buying A Home Regions

The Buyers Guide To Closing Costs Florida Realtors

The Buyers Guide To Closing Costs Florida Realtors

/home-sellers-paying-closing-cost-credits-4134262_FINAL-b881d78ab2234285b358324624cc0e16.png) How To Ask A Home Seller To Pay A Closing Cost Credit

How To Ask A Home Seller To Pay A Closing Cost Credit

How Much Are Closing Costs 2017 Real Estate Quotes Closing

How Much Are Closing Costs 2017 Real Estate Quotes Closing

Closing Costs What Are Closing Costs Zillow

Closing Costs What Are Closing Costs Zillow

Hidden Costs Fees Of Buying A Home

Closing Cost Who Pays What In Phoenix Arizona Phoenix Az Real

0 Response to "How Much Are Closing Costs When Buying A Home"

Post a Comment